I’m Melissa, Research Director at Spark, and I’ve spent many years helping financial services organisations understand their customers, navigate complexity and build brands that truly resonate.

This week I attended the MRS Financial Services Conference 2025, and the discussions reinforced something I’ve felt for a while: our industry is undergoing a great shift. Customers are changing, technology is accelerating and new forms of vulnerability are emerging. And the brands that will thrive are those that balance innovation with empathy – not one or the other, but both.

Across the day, three key themes cut through for me…

Emotional connection is becoming a true competitive advantage

We often talk about financial services as a category where rational, functional needs dominate. But the reality is far more nuanced. Money is emotional – tied to confidence, identity, aspiration, fear, pride, shame, resilience.

What stood out is how strongly emotional resonance now drives brand meaning, relevance, and ultimately growth. When people say they ‘love’ a financial brand, or when a campaign triggers recognition, reassurance or empowerment, it has a measurable commercial effect.

The industry is waking up to this truth: connection outperforms communication. The brands winning today are intentionally designing emotional value into their customer experience, marketing and product ecosystems.

Inclusion and resilience must be built in, not bolted on

A recurring theme was the uncomfortable but important reality that not everyone experiences the financial system equally. Communities facing cultural exclusion, structural barriers, digital divides or a lack of tailored support often feel the system wasn’t built for them.

Financial resilience isn’t just about numeracy or budgeting, but it’s shaped by confidence, cultural norms, perceived fairness, trust, and access to advice. Vulnerability is also far more widespread than many assume.

The takeaway?

Real progress means moving beyond surface-level ‘inclusion initiatives’ towards fundamentally rethinking how products, language, channels and decisioning are designed. Insight has a crucial role in identifying blind spots early, elevating underrepresented voices, and challenging default assumptions.

AI is accelerating, but trust will depend on transparency and human closeness

Generative AI and conversational tools are transforming how people seek information, ask questions and make decisions – but this shift comes with tension.

Consumers are curious, and many are already using AI for quick financial tasks – but they’re also wary, especially when it comes to advice, mortgages, debt support or investment guidance. People want innovation, but they want to know who is guiding them, how the information is generated, and whether they can trust it.

The message across sessions was clear: AI can absolutely build confidence and capability, but only if it feels human, transparent and safe. The future isn’t ‘AI vs humans’ – it’s ‘AI with humans’.

So where does this leave customer insight?

Insight functions now face a dual responsibility:

- Understand the emotional drivers behind people’s financial decisions

- Help organisations translate that understanding into timely action

This means moving beyond traditional reporting into approaches that are:

- Emotionally attuned, identifying the human stories behind the numbers

- Inclusive by default, hearing from those often overlooked

- Future-ready, exploring how trust evolves as new technologies emerge

- Embedded across teams, shaping strategy, design, comms and culture

We need methods that mirror the messy reality of real people’s lives, and ideally those that blend speed, depth, scale and nuance.

This is exactly where Spark’s Conversive sits

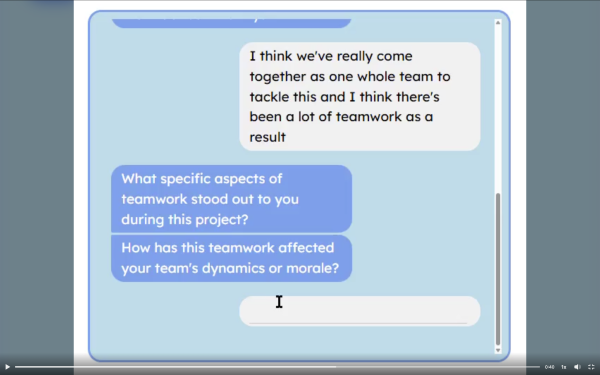

Conversive was built for this moment – especially in a world where AI is reshaping how people communicate, decide and seek support. Conversive is Spark’s AI-powered blended research solution, seamlessly embedded into your quant survey. It’s not just another open-end – it’s a responsive, chat-based experience that engages hundreds of participants in natural, human-like dialogue. Think of it as your virtual moderator, probing, listening, and learning in real time. It delivers all the richness of qual backed by the confidence of quant in one survey. It brings together:

- the power of AI, enabling natural, adaptive, human-like conversations at scale

- the robustness of quantitative measurement

- the richness of qualitative depth – all within a single integrated survey experience.

Rather than replacing human understanding, Conversive uses AI to enhance it – capturing nuance, emotional cues and contextual meaning that are often missed in traditional tools. It helps organisations understand:

- not just what customers are doing,

- but why they’re feeling the way they do,

- and how to support them with guidance that feels personal, relevant and reassuring.

In a financial landscape racing towards automation, Conversive keeps human connection at the centre of insight, using AI intelligently to deepen empathy, stretch reach, and provide a more complete picture of people’s financial lives.

If the MRS conference reinforced anything for me, it’s that financial services needs insight that sees the whole person – not just the behaviour. If you’d like to explore how Conversive can help you build deeper understanding, stronger connection and more inclusive financial experiences, feel free to get in touch: Melissa@SparkMR.com